- CCUS Basics

- State of play

What is the current status of CCUS and CCUS hubs?

The CCUS project pipeline is more robust than ever. Investment in CCUS almost tripled in 2022 to $6.4 billion, according to BloombergNEF, with a total of almost $12 billion invested over the past three years. The US led development with 45% of global investment, overtaking Europe, but the trend is broad, with large new investments in Australia, Malaysia and China.

The 2022 status report from the Global CCS Institute identifies 30 commercial CCUS facilities operating around the world, with a total capture capacity of about 43 million tonnes of carbon dioxide per year. While the number of projects in development rose to 196, an increase of 44%, the capacity of planned projects more than doubled and now totals 244 million tonnes per year.

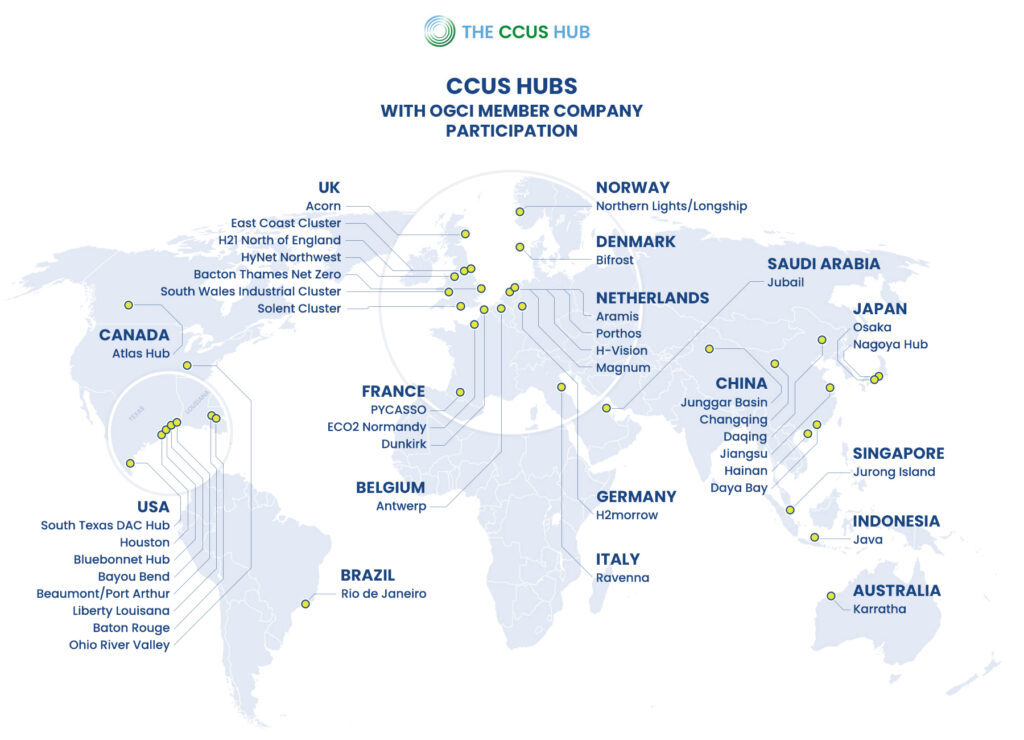

That capacity increase is largely due to CCUS hubs becoming the predominant method of deployment. According to the IEA, using a very wide definition, there are currently well over 100 CCUS hubs proposed or in development around the world, three times as many as in 2021. Over 40 of these hubs are being developed with the involvement of OGCI member companies (see map).

Growth is accelerating as governments and companies focus on how to implement net zero targets, interest in low carbon hydrogen grows and CCUS hubs open scalable options for industrial decarbonization.

- CCUS Basics

- State of play

CCUS hub trends in the US

Two major pieces of enabling legislation, designed to drive down costs and kickstart the CCUS industry, have transformed the hub landscape in the US. The Infrastructure Investment and Jobs Act, passed in November 2021, provided over $12 billion in funding for CCUS over five years. The Inflation Reduction Act enhanced the 45Q tax incentives, opening access to a wider group of emitters and extending validity (projects must start before 2033 to qualify and have 12 years of subsidies).

These changes have created confidence among potential hub operators that there will be funding now and until 2050. That has kickstarted a competitive race to snap up pore space and develop multiple connected hubs that would lower risk for operators.

Trends in 2023:

- There will be dozens of new announcements for hub projects as potential transport & storage operators sign leases to rent pore space.

- Competition is growing among hub operators to be first movers and get access to pore space that has the fewest old wells requiring expensive remediation.

- A few states will lead the way, including Texas, Louisiana and Wyoming – but interest is growing across the country as land-owners see a new revenue source.

- Pressure is growing from industrial emitters to get access to storage, with some looking to take equity in stores with the aim of gaining privileged access.

- Direct air capture facilities, which attract higher tax incentives and have an additional revenue stream from carbon credits, will play a significant role in many hubs as an anchor and risk-reduction mechanism for operators.

- The biggest roadblock for CCUS hubs will be Class VI well permitting, a process that despite federal and individual state efforts is moving significantly more slowly than incentives.

- With carbon dioxide pipeline infrastructure already widespread, pipeline operators are starting to become key players connecting multiple storage sites. Long-distance pipelines are unlikely to get permits.

- There will be a push to add new sources of value such as low carbon premiums and standards.

- CCUS Basics

- State of play

CCUS hub trends in Europe

CCUS hubs are becoming part of mainstream industrial decarbonization strategies in many European countries, driven by projects in Norway, the UK, the Netherlands and Iceland. These were built on a fledgling set of funding incentives and regulations, but in response to US incentives, both the EU (Net Zero Industry Act) and national governments are currently developing new policy mechanisms and targets to support CCUS.

These developments look set to lead to a more comprehensive network of carbon management infrastructure that will connect hubs and generate increasing demand for carbon dioxide storage options from industrial emitters. The EU’s CCUS Forum forecasts demand for storage services will rise from a very low base to 80 million tonnes in 2030, reaching 300 million tonnes by 2040.

Trends in 2023:

- Multi-modal, cross-border carbon transport infrastructure is developing across Europe to feed into carbon stores, especially around the North Sea.

- Several countries with storage capacity (particularly Norway, Denmark and Iceland) are focused on developing CCUS hubs as a lucrative service for European industry and governments.

- The European Commission will release a strategic vision for carbon capture in spring 2023, focusing on future funding models, infrastructure (including pipelines) and easier permitting.

- Bans on commercial-scale underground storage of carbon dioxide are being repealed, notably in Germany where the government is currently legalising geological storage and participating in cross-border infrastructure projects in order to sustain industrial competitiveness.

- The next generation of transport and storage hub projects is starting to emerge, relying on demand from and fees paid by emitters, rather than on capital grants or regulated assets.

- Onshore storage is no longer taboo in Europe, with Denmark conducting a survey of capacity and a pilot project.

- CCUS Basics

- State of play

CCUS hub trends in Asia-Pacific

There is huge potential for CCUS hubs in the Asia-Pacific region. A few hub projects are already underway in China (see Junggar Basin) and Australia; India recently announced it wanted to focus more on CCUS and Japan is exploring how to use depleted gas fields for CCUS.

What is really driving new CCUS hub developments, however, is demand from industrial countries with high industrial emissions but inadequate storage capacity – such as Japan, South Korea and Singapore – to gain access to significant underground storage resources in other parts of Asia (in particular, Malaysia, Australia, Indonesia, China and possibly the Gulf states.)

A number of innovative cross-border hub concepts are emerging to bring these sources and sinks together. Some of these are based on a shipping model (for example, one project aims to bring emissions from South Korean companies to Malaysia for storage). Others are based on importing already abated energy sources (LNG, ammonia, hydrogen), supporting CCUS as needed in the country of origin or closer to the point of use.

These complex projects can build on a long history in Asia with the type of public-private ecosystems needed to develop CCUS hubs. Overall regulations and incentives, however, are still insufficient. Indonesia passed Southeast Asia’s first regulations to enable the development of commercial scale CCUS projects in March 2023.

- CCUS Basics

- State of play

Why is CCUS taking off now?

Governments and businesses are increasingly realizing that climate action is urgent, spurred in part by recent IPCC reports. Over 130 countries and over 800 of the world’s 2,000 largest companies have net zero targets. As they implement them, they require solutions for decarbonizing hard-to-abate sectors such as steel, cement and chemicals. They also need solutions for negative emissions. CCUS is a ready solution.

In the past, CCUS tended to be viewed primarily as a way to decarbonize power. As a result, its cost was seen in relation to renewables. Now, both governments and businesses understand that its main value is in relation to industrial decarbonization strategies. In that light, CCUS can be the cheapest and quickest way to achieve rapid decarbonization while sustaining an industrial base and jobs. The infrastructure it creates can also be used to deploy carbon removal technologies.

Higher carbon prices, particularly in Europe, are driving emitters to look for new low-carbon strategies. The emergence of CCUS hubs provides emitters with an affordable service to abate their emissions.

Policy incentives and regulations for CCUS are maturing, particularly in Europe and North America but increasingly in Asia-Pacific too. And there is now a huge quantity of finance seeking ethical investments, with ESG (environmental, social and governance) assets projected to reach $34 trillion by 2026.

This new momentum is now visible, with the number of new CCUS projects accelerating and investment tripling in 2022.