Policies & regulations

What policies are governments using to incentivize capture, transport and storage in CCUS hubs – and how long will government support be needed?

- Policies & business models

- Policies & regulations

Why should governments support CCUS hubs?

Governments have committed over $6 billion to accelerate the deployment of CCUS since 2021, led by the US, EU, Australia and the UK. They are driven by the recognition that accelerating the pace of industrial decarbonization will depend on the build-out of carbon management infrastructure.

There will be new technologies and approaches that transform heavy industrial sectors, but CCUS is currently one of the few viable ways to remove emissions from products such as cement, chemicals, fertilizers and waste incineration – those that require intense heat and even involve chemical processes that themselves produce carbon dioxide. Building out carbon transport and storage infrastructure will facilitate that hard-to-abate decarbonization, but it will also enable the production of abated power and clean hydrogen, and help scale up high-durability carbon removals. That makes it a no-regrets net zero strategy, rather than a transitional measure.

Supporting CCUS hubs, rather than one-off projects, is now seen as one of the most cost-effective ways to enable industrial decarbonization. Hubs leverage economies of scale, while reducing costs by allocating risk management along the entire value chain. That helps governments to meet interim and long-term national climate targets.

CCUS helps to enable a just transition, allowing existing industries to remain competitive, keep and create jobs and continue contributing to local economies while transitioning to a net-zero future. A CCUS hub can help industrial regions to keep existing industrial jobs. It also helps to attract new businesses close to storage areas, creating jobs and growth in industrial regions. The UK government expects CCUS to support up to 50,000 jobs and create a significant export opportunity.

CCUS hubs accelerate the commercial scale up of CCUS technologies and can help to create a new carbon management industry. Policy support can enable faster decarbonization in the short and medium term, tailormade to the specifics of one or more CCUS hubs, and phase out that support over time as a commercial industry evolves. For countries with significant geological storage resources, that can open up a significant new cross-border industry as a carbon manager for larger regions.

- Watch Brad Crabtree of the Department of Energy talk about how the US is incentivizing commercialization of CCUS (04.58 – 9.00)

Flexible power generation capacity that complements renewables can be an integral part of a CCUS hub – providing reliable low-carbon power for businesses in the hub area.

- Read about the UK government’s business model for dispatchable power with CCUS and standard contract terms

Hydrogen is set to play a big role in decarbonizing industry, heating and transport, and the cheapest way to make low-carbon hydrogen today is using natural gas with CCUS. Integrating low-carbon hydrogen production into a hub provides energy for multiple applications in the industrial region.

- Read about hydrogen at H2H Saltend in the East Coast Cluster

CCUS hubs can also provide opportunities to remove carbon dioxide from the atmosphere at scale, through direct air capture with storage (DACS) and bioenergy with CCS (BECCS).

- Read about Stockholm Exergi’s BECCS project, with storage planned in Northern Lights

- Policies & business models

- Policies & regulations

Why do CCUS hubs need government support?

Today’s market models make it more favourable for industrial companies to emit carbon dioxide (even where carbon has a cost) than to invest in carbon capture and have the carbon dioxide stored. As carbon prices rise, incentives develop and mandates kick in, CCUS will become cheaper than emitting.

The most advanced CCUS hubs today are supported by government-backed incentives and subsidies that tackle two main challenges:

- Incentivising emitters to invest in capturing their carbon dioxide emissions – so they can maintain competitiveness despite today’s market models

- Incentivising potential carbon transport and storage operators to invest in infrastructure – providing a business case despite the lack of a sufficiently high and stable carbon price to ensure demand

In addition, the incentives also need to address challenges throughout the CCUS value chain like performance risk and counterparty risk.

Policy support is likely to match the dynamics of low-carbon energies such as offshore wind:

- Early-stage demonstration focuses on proving that a novel technology works in practice. Scale-up develops a few projects near or at full-scale, proving viability and deliverability. In these initial phases, governments are likely to offer some form of development funding, followed by upfront co-funding of capital costs, as well as revenue support.

- At roll-out, the objectives are to establish a sustainable industry and to build capacity, via a funnel of projects, multiple developers, and a mature understanding of risks and contracting structures. As risks and costs fall, and the cost of private finance comes down, CCUS hub development could be driven by industry and supported by market-based mechanisms, based on giving a value to carbon. Government co-funding of the costs could then be phased out as commerciality is reached.

- Once established, a mature and stable industry can attract commercial finance on acceptable terms. CCUS hubs will be sustained by an explicit or implicit carbon price, supported by further reductions in the cost of technology applied, and by growing demand for decarbonised industrial products. In this phase, government action would be limited to addressing any remaining market failures and removal of regulatory barriers.

- Policies & business models

- Policies & regulations

What kind of policy enablers can support CCUS hubs?

Governments are using a range of different policy frameworks to help a CCUS industry get off the ground and scale rapidly. Government support is expected to decrease over time as the industry matures and sufficiently high carbon prices, mandates and/or market demand for low carbon products create business models.

These are the most common tools governments are using in different combinations to support the large-scale deployment of CCUS, especially through CCUS hubs. In most cases, mechanisms are stackable for the user to create a viable business model.

Grants/loans

- Capital grants support investment in developing and deploying large-scale capture, transport and storage facilities. Particularly relevant in the early phases of CCUS hub development, these grant schemes can also include support for the operations phase, including minimum performance requirements.

- Loans can offer preferential interest rates to support investment in CCUS.

- Feasibility study grants are designed to help emitting companies in industries with tight profit margins to do due diligence on integrating CCUS into their processes. This is particularly important for companies that are pioneering the use of CCUS in their industry, such as waste-to-energy, glass and paper.

Carbon price

- Carbon taxes on emissions, fossil fuel production, import or supply, often with revenues earmarked to subsidise clean technology projects through grants, as in Norway, Sweden and Denmark.

- Emissions Trading Schemes set a carbon price that supports low-carbon technologies by reducing the cost of compliance. These can be cap and trade schemes as in the EU and UK, or benchmark and trade schemes such as the Australian Carbon Credit Units.

- Carbon Border Adjustment Mechanisms, as in the EU, extend carbon pricing regimes to trade partners that are importing carbon-intensive products.

Tax incentives

- Tax credits incentivize deployment according to tonne of carbon dioxide stored, as in the US 45Q credit, or via investment in CCUS equipment and infrastructure (as in Canada).

Public procurement

- Contracts for Difference use the public procurement system to set a minimum price on stored carbon dioxide, paying the difference between the current market price and this floor, as in the UK (Industrial Carbon Contract) and Netherlands (SDE++). These are similar to Dispatchable Power Agreements, for power plants with CCUS that provide back-up power as needed to the grid.

- Emissions performance standards for industry, power or products, such as California’s Low Carbon Fuel Standards, now used by several states and provinces in North America.

Regulations

- Carbon Storage Obligations are a polluter-pays model obliging fossil fuel companies to store geologically the carbon dioxide equivalent of any fuel extracted or imported. Not yet introduced anywhere, but under discussion.

- Regulated Asset Base, as in the UK, sees transport and storage operators receive a licence from the regulator, granting them the right to charge an independently regulated price to users in exchange for delivering and operating the transport and storage network.

- Policies & business models

- Policies & regulations

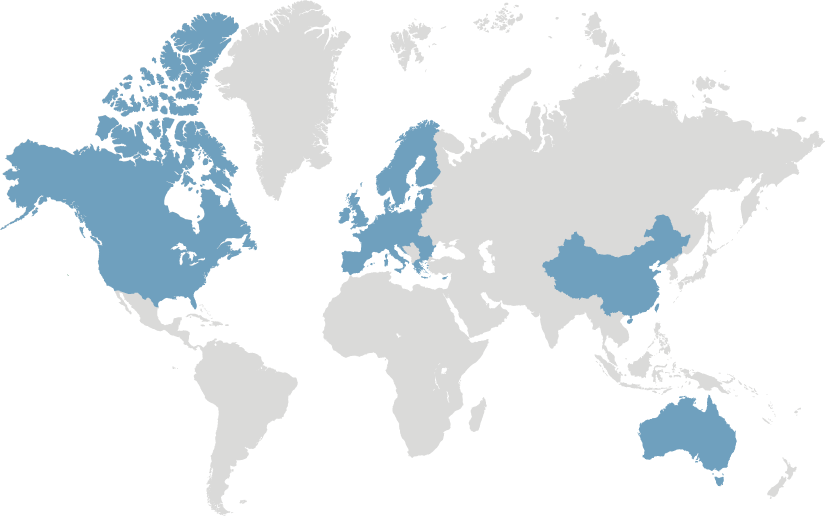

Policy support mechanisms by country

More and more countries are introducing policy incentives to accelerate CCUS hubs and projects, as part of broader decarbonization strategies.

Use this tool to find specific policies around the world.

- Policies & business models

- Policies & regulations

Designing effective policies for CCUS hubs

Identify the potential and value of CCUS

- Map sources of carbon dioxide from industry and power plants with their concentration and purity

- Map storage reservoirs, their type and capacities – saline aquifers, depleted oil and gas reservoirs

- Identify carbon transport options – pipelines, ships, barges, rail, trucks

- Quantify the socio-economic value of CCUS, including its potential for retaining and creating jobs

Set up national CCUS strategy and targets

- Articulate the role CCUS can play versus other levers to accelerate decarbonization in the national context

- Integrate CCUS into industrial, commercial and environmental policy

- Give relevant ministries the resources they need for implementation

- Develop a roadmap laying out targets for captured carbon dioxide

- Ensure a funnel of storage resource options are appraised in a timely manner to match the expected demand from captured carbon dioxide

- Design incentives to ensure industries meet those targets

- Provide support for storage maturation

- Review frameworks regularly to ensure they are keeping up with developments

Provide clarity with regulations

- Clarify issues around carbon transport, verification of capture and storage, the integrity of storage sites, monitoring, and long-term stewardship.

- Design permitting process to be streamlined across the numerous regulatory actors

Assign roles and responsibilities.

- Assign roles and responsibilities to the appropriate authorities for developing policies, incentives, and regulatory frameworks.

- Doing so transparently and predictably in the context of a roadmap reduces uncertainties and de-risks capital investments

- In many cases it will be beneficial to assign one party to take the lead role for a CCUS hub development

Work on community acceptance

- Collaborate with local government, environmental organizations, trade unions, and other industries in the region

You might also be interested in:

- Policies & business models

- Policies & regulations

Developing effective regulations for CCUS hubs

Regulations relating to CCUS vary considerably by country. In order for CCUS hubs to scale, consistent regulations across geographies are necessary. Suggested guidelines for developing such regulations are as follows:

- Permit the adaptation of existing pipelines for carbon dioxide transport

- Enable new transport infrastructure such as pipelines, trucks, rail, ships and barges

- Streamline the process of awarding permits for capture, transport and storage

- Introduce standards for construction, operation and carbon dioxide injection

- Clarify storage liability: who is responsible at each stage of injection, monitoring and long-term stewardship; how is risk shared and eventually transferred to government.

- Introduce monitoring, reporting and verification protocols and processes for injected carbon dioxide to ensure safe, reliable, and permanent storage

- Establish provisions for carbon dioxide leakage

- Provide legal certainty on pore-space ownership and how it relates to mineral rights

- Develop rules for joint development of carbon dioxide stores that span land under licence by different companies

- Enable trans-boundary (state and national) movement and storage of carbon dioxide, including the delineation of associated risks and liabilities

- Ensure that emitters have access to carbon transport and storage infrastructure at reasonable rates

- Establish processes for stakeholder consultation

Policies & Business Models

Identify a potential CCUS hub in your region

Explore policies by country